Strong performance in challenging conditions

IDP Education

28 October 2025IDP Education (ASX: IEL) announced its results on 29 August, 2024 for the 2024 financial year (FY24).

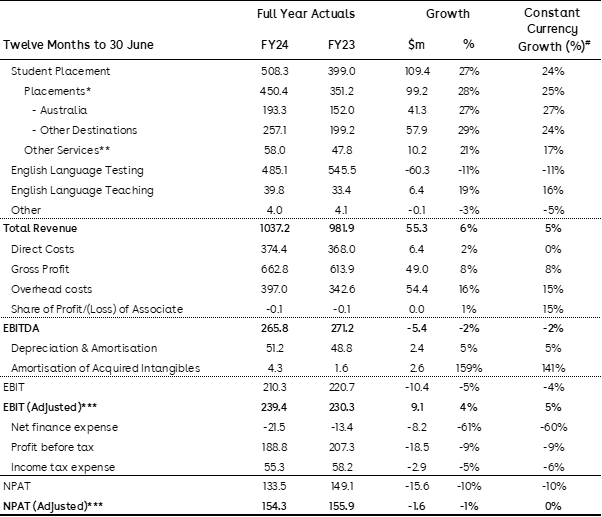

Key results for the twelve months to 30 June 2024, compared to the prior corresponding period include:

Record revenue of $1,037 million, up 6 per cent, driven by strong student placement revenue growth of 27 per cent

Adjusted(i) earnings before interest and tax (EBIT) of $239 million, up 4 per cent and adjusted Net Profit After Tax (NPAT) of $154 million, down 1 per cent

On an unadjusted basis EBIT and NPAT were down 5 per cent and 10 per cent, respectively

Record student placement volumes of 98,900, up 17 per cent, demonstrating strong market share growth

English language testing (IELTS) volumes of 1,584,100, down 18 per cent, reflecting uncertainty in key destination market policy settings

English language teaching volumes of 106,600, up 13 per cent

Tennealle O’Shannessy, IDP's Chief Executive Officer and Managing Director, said the results demonstrate IDP’s leading position in an industry impacted by short-term shifts in market dynamics.

“We are proud of the results our global team delivered in FY24, despite the international education sector’s well-documented regulatory challenges,” Ms O’Shannessy said.

“Our achievements highlight IDP’s focus on delivering quality services and commitment to our long-term strategy,” she said.

IDP’s record student placement revenue was driven by strong increases in both volume and price.

IDP’s student placement business significantly outperformed the market, achieving 17 per cent volume growth, while the broader industry saw a 13 per cent volume decline(ii) due to tighter visa settings in key destination markets.

IDP’s student placement volume growth to Canada was up 31 per cent, US up 26 per cent, Australia up 17 per cent and UK up 3 per cent.

Contributing to the strong growth in placement revenue was a 10 per cent increase in average price, reflecting IDP’s premium services for higher education institutions.

Revenue from Other Student Placement services, which includes digital marketing, events, data services and consultancy, was up 21 per cent. This growth also reflects the inclusion of revenue from The Ambassador Platform, with peer-to-peer marketing services being incorporated into IDP’s product portfolio.

IELTS volumes were down 18 per cent primarily due to declines in India, a market impacted by negative test-taker sentiment towards regulatory and visa uncertainty in key destinations. Outside of India, IELTS volumes were up 12 per cent with strong performance from Vietnam, Pakistan and Bangladesh alongside solid growth in IDP’s onshore markets, Australia and Canada. IDP’s English language teaching business in Cambodia (ACE) reinforced its market leadership and increased its course volumes by 13 per cent.

Delivering on key strategic priorities

Strategic highlights delivered in FY24 include:

Integrated Intake Education's 27 offices across seven countries, including 12 new offices in Sub-Saharan Africa, into IDP’s global network

Facilitated over 32,000 offers through FastLane, an 83 per cent increase from FY23

Launched a new student ambassador solution to drive peer-to-peer engagement and create the definitive international student community

Increased Student NPS by seven points, the largest annual increase since the NPS program began

Welcomed 50 new higher education clients to our student placement portfolio, including 23 in the US

Completed the roll-out of the new IELTS testing platform, providing additional scalability and flexibility for future product delivery

Expanded the acceptance of IELTS One Skill Retake with the UK and New Zealand governments formally approving its use for visa purposes along with over 1,800 other recognising organisations.

Regulatory and Market

The regulatory and market environment for international education remains dynamic, however IDP remains well-positioned to manage the short-term cyclical trends as it has done over many years.

On 27 August, the Australian Government provided some further details on its proposed international student caps. IDP believes that the Australian Government has been managing international student volumes within the context of a broader net overseas migration target and that the proposed caps and the various changes to visa processing and fees are levers that the Government is using to reduce arrivals and increase departures to achieve that overarching target.

As with similar regulatory developments that have occurred in other destination markets over the past 6-12 months, it will take some time for the sector to work through the proposed changes at an institutional level, see evidence of changes to visa processing and assess the impact on student sentiment and demand.

Whilst the global outlook will continue to take shape as markets respond and further details emerge, based on recent trends and currently available information, we reiterate our view on the overall global market for FY25. That is, assuming no further change in key immigration and visa policy settings, we expect that international student volumes (as measured by the total number of new international students commencing study in IDP’s six key destination markets), will decline by 20-25% in FY25 relative to the volumes experienced in FY24.

Incorporated within that outlook is an assumed decline for Australia which aligns with recent trends and with the overarching targets incorporated within the Government’s documented net overseas migration objectives.

From an IDP perspective, given the outlook for the overall market, we expect to record a decline in volumes in our key business lines in FY25 but would expect to continue to outperform the broader market decline outlined above.

“Although current market conditions may be challenging, our genuine commitment to transforming lives through international education underpins all aspects of our operations and will guide us through this current period,” Ms O’Shannessy said.

As the leading quality player in the sector, IDP remains very well placed to help students and institutions navigate these challenging market conditions.

The focus of the business in the near term is on three key areas:

1. Market share – The sector’s increased focus on quality and the unique services that IDP provides is expected to drive meaningful market share increases in student placement.

2. Product innovation – Investment in strategic growth areas will continue to ensure growth can accelerate when market conditions improve.

3. Cost management – IDP implemented a cost reduction program in late FY24. The savings identified during that process will enable IDP to continue to invest in growth drivers, strategic programs and to appropriately reward and retain its experienced global team. Management will continue to manage costs in a disciplined manner whilst balancing the need to invest to maximise long-term shareholder returns.

Despite the current cyclical dynamics, IDP remains confident in the long-term structural growth drivers for the international education market. While governments in several countries are currently seeking to temporarily reduce migration levels, IDP believes the long-dated structural growth drivers that underpin the economic and social importance of the international education industry, and immigration more broadly, will underpin the market’s long-term growth trajectory.

“Our clear strategy, expert team, and disciplined investment approach position us well to lift industry standards and help more customers achieve their big global goals,” Ms O’Shannessy said.

The Board of Directors declared a final dividend of 9 cents per share taking full-year declared dividends to 34 cents per share, which is a decrease of 17 per cent.

Summary Income Statement (A$m)

* Placements revenue includes all commissions received from institutions for the placement of a student into a course plus any fees paid by students to IDP or revenue generated via sale of a “Student Essentials” product ** Other services related to Student Placement includes all revenue received from institutions for digital marketing, events, consultancy and data services, or peer-to-peer marketing via The Ambassador Platform *** EBIT (Adjusted), NPAT (Adjusted) excludes intangible asset amortisation generated from business combinations, M&A related expenses, unrealised FX losses, credit loss provision for customers in countries subject to foreign exchange controls and costs associated with business restructuring. # “Constant Currency Growth” is calculated by restating the prior comparable period’s financial results using the actual FX rates that were recorded during the current period.

This announcement was authorised for release by the Board of Directors of IDP.

About IDP Education

IDP is a global leader in international student placement and a proud co-owner of the world’s most popular high-stakes English language test, IELTS.

We specialise in combining human expertise with digital technology to help people get accepted into their ideal course, take an English language test or learn English in our schools. Our teams work side-by-side with our customers through every step, from course search to starting their dream course or career.

We partner with more than 800 quality universities and institutions across Australia, Canada, Ireland, New Zealand, the UK and the USA. Our data insights are relied upon by organisations around the world to help ensure policies are informed by the diverse needs, challenges and motivations of students.

Disclaimer

The material in this announcement has been prepared by IDP Education Limited (ASX: IEL) ABN 59 117 676 463 (“IDP Education") and is general background information about IDP Education’s activities current as at the date of this announcement. The information is given in summary form and does not purport to be complete. In particular you are cautioned not to place undue reliance on any forward looking statements regarding our belief, intent or expectations with respect to IDP Education’s businesses, market conditions and/or results of operations, as although due care has been used in the preparation of such statements, actual results may vary in a material manner. Information in this announcement, including forecast financial information, should not be considered as advice or a recommendation to investors or potential investors in relation to holding, purchasing or selling securities. Before acting on any information you should consider the appropriateness of the information having regard to these matters, any relevant offer document and in particular, you should seek independent financial advice.

Non-IFRS Financial Information

IDP Education uses certain measures to manage and report on its business that are not recognised under Australian Accounting Standards. These measures are collectively referred to as non-IFRS financial measures. Although IDP Education believes that these measures provide useful information about the financial performance of IDP Education, they should be considered as supplemental to the measures calculated in accordance with Australian Accounting Standards and not as a replacement for them. Because these non-IFRS financial measures are not based on Australian Accounting Standards, they do not have standard definitions, and the way IDP Education calculates these measures may differ from similarly titled measures used by other companies. Readers should therefore not place undue reliance on these non-IFRS financial measures.

Recent news and press releases

25 February 2026

IDP partners with new Adelaide University to support global student recruitment from day one

Read moreIDP partners with new Adelaide University to support global student recruitment from day one

IDP has partnered with the newly established Adelaide University from its very first intake, working together through an Innovation Partnership to shape a future‑focused international recruitment strategy.

Read more16 February 2026

Coming full circle: how international education creates lifelong global connections

Read moreComing full circle: how international education creates lifelong global connections

Melina Chan’s international study journey shows how global education builds lifelong skills, resilience and connections that span borders.

Read more